![Extending the Export Obligation Period [EOP/EO] within the EPCG Scheme Extending the Export Obligation Period [EOP/EO] within the EPCG Scheme](https://gspfinanceco.com/wp-content/uploads/2023/09/Weekly-Exim-UpdatesNewsletter-GCo-21st-to-27th-August-2023.jpg)

In this blog, we will be discussing the Export Obligation Period (EOP) or Export Obligation [EO] Extension under the EPCG Scheme.

The need for an EOP extension arises when you are unable to fulfill your export obligation within the given time frame of 6 or 8 years.

Especially due to the impact of COVID [Corona Pandemic], many companies have been unable to meet their obligations within the stipulated time frame.

In this blog, we will cover topics such as the duration of EOP extension, how many times it can be extended, the associated fees, and particularly, we will delve into the COVID relaxation notifications. We will discuss these notifications with practical case studies to provide a clear understanding. So, let’s begin.

Different Types of EPCG Authorisations and their EO Extensions

The EPCG licenses issued under the Concessional Duty EPCG scheme, with duty rates of 3% and 5%, come with an Export Obligation (EO) period of 8 years.

For the Zero Duty EPCG Scheme licenses issued after the year 2012/13, their EO period is set at 6 years.

EPCG licenses with an EO period of 8 years are eligible for 2 EO extensions, each of 2 years, totaling 4 additional years. Therefore, the total EO period for such licenses becomes 12 years (8 + 4).

EPCG licenses with an EO period of 6 years are eligible for 2 EO extensions, each of 1 year, totaling 2 additional years. This results in a total EO period of 8 years (6 + 2).

It’s important to note that regional offices of DGFT cannot grant extensions over and above 12 years or 8 years respectively. For additional extensions, you need to approach the EPCG Committee in New Delhi.

[If you’re unfamiliar with the EPCG Committee and its role, please go through our detailed blog on the EPCG Committee. In the blog, we explain what the EPCG Committee is, how it processes different case types, and other related concepts – EPCG Committee DGFT Delhi]

For extensions granted under the Zero Duty EPCG Scheme, there are Government Fees or Composition Fees involved. These fees amount to 2% of the proportionate Duty saved on the unfulfilled Export obligation for each year of extension.

Please watch our short Youtube video to understand this topic in detail. It covers the concepts like duration of EOP extension, how many times it can be extended, the associated fees, and particularly, COVID relaxation notifications for EPCG Scheme with practical examples in Hindi.

COVID Relaxation Notifications under EPCG Scheme

DGFT issued a total of 3 relaxation notifications to provide relief and extensions in the Export Obligation (EO) period for EPCG License holders due to the COVID pandemic.

The first notification was PN 67 dated March 31, 2020. The second was Notification No. 28 dated September 23, 2021. The third one was PN 53 dated January 20, 2023.

In the image, we have simplified the explanations for these three notifications. One important note to keep in mind is that the relaxation provided by PN 53 is available only if you haven’t already availed the benefits of PN 67 or Notification 28. Additionally, PN 53 has specific terms and conditions for EPCG license holders in the Hotel, Healthcare, and Educational sectors, which you can refer to.

Sr. No.

Notification No. & Date

Relaxation Given

Conditions

1

PN 67 Dated. 31st March 2020

If the Export obligation period expires between 1st Feb 2020 to 31st July 2020, then the EO period will be automatically extended by 6 months.

No Additional Fees to be paid.

2

Notification No. 28 dated. 23 September 2021

If the Original or Extended Export Obligation period expires between 1st August 2020 to 31st July 2021, then the EO period will be extended till 31.12.2021.

No composition fees. However additional EO of 5% to be imposed on value terms [FFE] on balance export obligation.

3

PN 53 Dated. 20th January 2023.

EO period may be extended from the date of expiry, for the number of days, the existing EO period of an authorisation falls within 01.02.2020 and 31.07.2021.

This relaxation is available only if benefit under PN 67 and Notification 28 not taken.

3.

No composition Fees

However, additional EO of 5% to be imposed on value terms [FFE] on balance export obligation.

Understanding these notifications might not be straightforward, so in the next section, we will explain them using practical case study examples.

Practical Example to understand COVID Relaxations under EPCG Scheme

As we discussed in the first section of this blog, for the Zero Duty EPCG Scheme, the initial Export Obligation period (EOP) is 6 years, and you can take two extensions of 1 year each as per existing policy provisions. So, the total EOP becomes 8 years (6 + 2).

The COVID-related relaxations are in addition to the regular extensions that you can take as per the policy provisions.

Now, let’s understand this with an example. Consider you have a Zero Duty EPCG License dated August 26, 2014, with an initial EOP of 6 years.

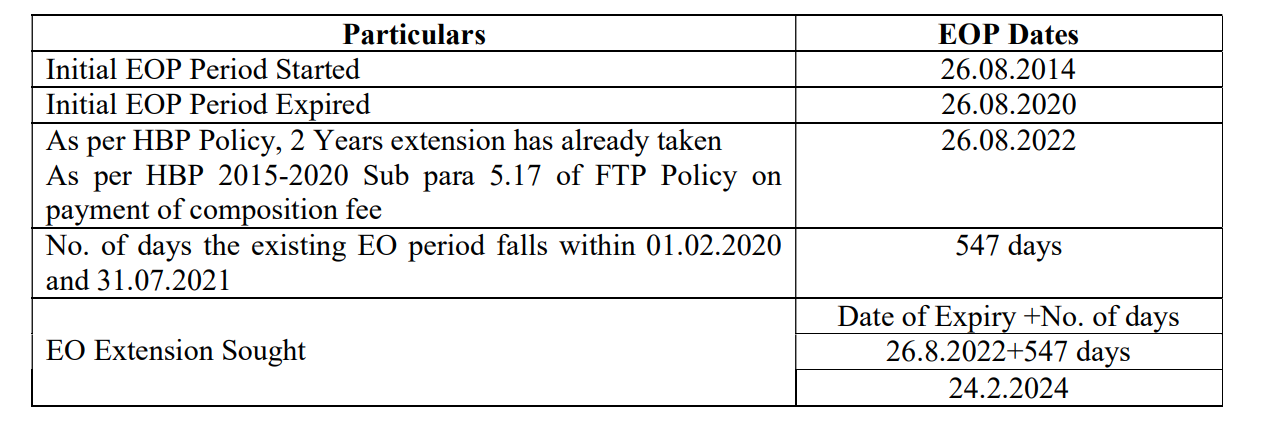

As shown in the image, you can see that the initial EOP will end on August 26, 2020. After that, by paying the Composition Fees, you can take a 2-year extension until August 26, 2022.

Here, please take note that you haven’t availed the benefit under PN 67 and Notification 28. Therefore, you are eligible to avail the benefit under PN 53.

As per PN 53, the number of days that fall within the initial/extended EO period from February 01, 2020, to July 31, 2021, is exactly 547 days. The rationale behind this is that due to the impact of COVID, we lost 547 days, which were part of our existing EO period. So, DGFT is granting an extension of these lost days.

Consequently, the final extension for this specific license would be until February 24, 2024 (26.08.2022 + 547 days) = 24.02.2024.

I trust this example clarifies the concept.

Who are We and Why Choose Us

We at AFLEO Group, are a team of DGFT & Customs Experts having a rich experience of 10+ Years in Exim Consultancy & International Logistics [Freight Forwarding] and also deal in Buy/Sell/RODTEP/ROSCTL/DFIA License With our vast knowledge and experience in this field we can represent your case for all the activities pertaining to the EPCG Scheme – Application/Redemption/EOP Extension and get it in a hassle-free manner. We are well-equipped to handle the logistics of global trade with efficiency and expertise. Let us handle the logistics while you focus on growing your business. Contact us today to learn more about how we can help you streamline your supply chain and increase your bottom line. We are dedicated to providing efficient and cost-effective logistics services to help our clients.

So do get in touch with us for any of your requirements and our team will be happy to help you.

We request you to share this information with your other Industry friends, Trade associations, as this information might help them as well.

[Not sure whether your company is taking all the Export incentives notified by the Government? – Refer to our article on “18 latest Export promotion schemes/Export Incentives in India”]

Have any doubts? Please fill the form below to get in touch with us.