by Calculated Risk on 9/20/2023 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.4 percent from

one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage

Applications Survey for the week ending September 15, 2023. Last week’s results included an adjustment

for the Labor Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 5.4 percent on

a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 16

percent compared with the previous week. The Refinance Index increased 13 percent from the previous

week and was 29 percent lower than the same week one year ago. The seasonally adjusted Purchase

Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 12 percent

compared with the previous week and was 26 percent lower than the same week one year ago.

“Mortgage applications increased last week, despite the 30-year fixed rate edging back up to 7.31 percent

– its highest level in four weeks,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist.

“Purchase applications increased for conventional and FHA loans over the week but remained 26 percent

lower than the same week a year ago, as homebuyers continue to face higher rates and limited for-sale

inventory, which have made purchase conditions more challenging. Refinance applications also increased

last week but are still almost 30 percent lower than the same week last year.”

Added Kan, “The average loan size on a purchase application was $416,800, the highest level in six

weeks. Home prices in many markets have been supported by low inventory and resilient housing

demand for available homes.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances

($726,200 or less) increased to 7.31 percent from 7.27 percent, with points remaining unchanged from

0.72 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

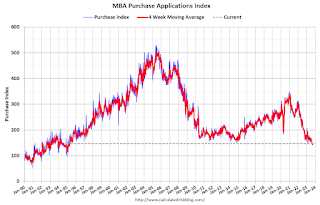

The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 26% year-over-year unadjusted.

Red is a four-week average (blue is weekly).

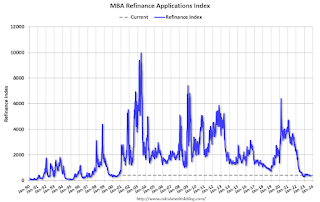

With higher mortgage rates, the refinance index declined sharply in 2022 – and has mostly flat lined at a low level since then.